In re Myhre, 2013 W.L. 3872509 (Bankr. W.D. Wis. 2013)

Contents

Student loan debt is dischargeable in bankruptcy if repayment is an undue hardship.

Although this case is based out of Wisconsin, many of the principles outlined in this post apply to Ohio bankruptcy filers as well. Generally speaking, courts will not allow for discharge of student loan debt unless the debtor can prove undue hardship.

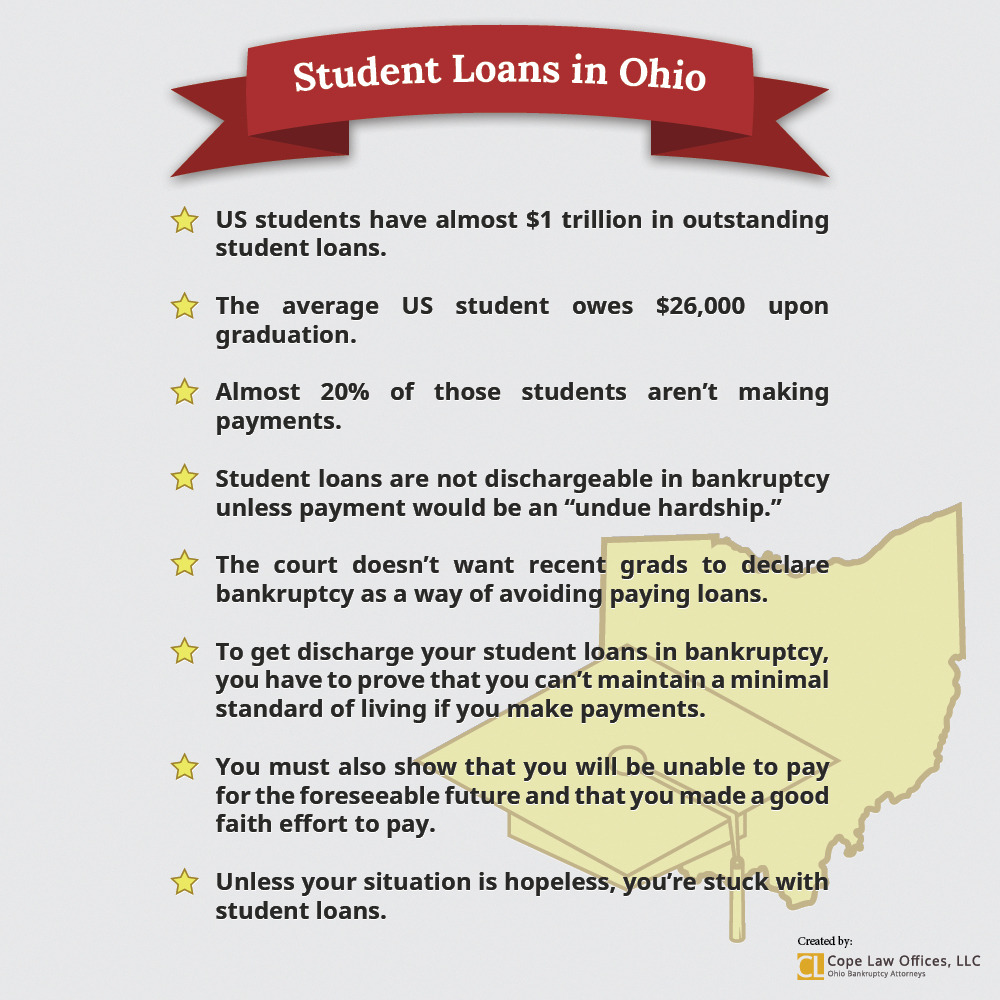

The amount of student loans outstanding in the United States is almost $1 trillion. College graduates today owe $26,000 on average and almost 20% of them aren’t making payments. Student loan debts are generally not dischargeable in bankruptcy, so if you have student loans and you’re not making enough money to cover the payments, there’s usually not much you can do about it. The court will discharge your student debts only if there is no hope that you’ll ever be able to repay them.

What does this mean? Let’s use case law as an example.

Bradley worked as a laborer making hardwood trim. He wasn’t educated, but he worked hard and supported himself. In 1994, he slipped on a swimming pool ladder and broke his neck – he was paralyzed from the chest down. He had no use of his legs, limited mobility in his arms and almost no use of his hands and fingers. For the rest of his life, he would be confined to an electric wheelchair and require help with even the most basic tasks, including eating, dressing, and bathing. In re Myhre, 2013 W.L. 3872509 (Bankr. W.D. Wis. 2013)

Bradley received disability income from the government, but decided to attend college and find employment despite his disability. He earned an associate’s degree in computer programming and then spent five years applying for work without success. He took out about $14,000 worth of student loans and returned to school to earn his bachelor’s degree. While he was still in school, Workforce Connections hired him as a programmer. He finished the semester and then went to work as a database administrator and web developer. Id.

Bradley earned between $30,000 and $35,000 annually at Workforce Connections for a monthly income of around $2,000 after taxes. With his disability, however, his monthly expenses totaled more than $3,500. He survived with the help of a caretaker; she spent $1,500 each month out of her own pocket to cover Bradley’s basic expenses. Even then, Bradley had to use a credit card to cover some of his expenses. Bradley struggled to make ends meet, let alone repay his credit card debt and student loans. In 2012, both he and his caretaker filed for bankruptcy. Id. Bradley sought discharge of his student loan.

Undue Hardship Analysis

Student loan debt is not dischargeable in bankruptcy unless it would impose an “undue hardship” on the debtor to repay the loan. The court looks at three factors when determining whether student loans impose an undue hardship on the debtor:

(1) that the debtor cannot maintain, based on current income and expense, a “minimal” standard of living for himself and [his] dependents if forced to repay the loans; (2) that additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans; and (3) that the debtor has made good faith efforts to repay the loans.

Id. at 3, citing In re Roberson, 999 F.2d 1132, 1135 (7th Cir. 1993). In other words, there must be a “certainty of hopelessness” that the debtor will be able to repay his loans. Id., citing Roberson, 999 F.2d at 1136. This is a very high bar, and discharges of student loans are extremely rare.

First, the court noted that Bradley already couldn’t afford his expenses, which were dominated by the constant medical costs associated with quadriplegia. Second, his condition was not going to improve in the foreseeable future; he could only look forward to 2% annual salary increases at Workforce Connections. Given the difficulty he had in obtaining employment in the first place due to his disability, it was unlikely that he would be able to find a better position elsewhere. Third, Bradley deferred his loans every year and never made payments; however, the court noted that he found employment and gained independence from government support. By deferring the loans, he “indicated a willingness to work within the repayment framework and pay if funds became available.” Id. at 6.

In a Rare Ruling, Student Loans Discharged

Bradley met all three criteria for undue hardship and the bankruptcy court discharged his student loans. He would still struggle to make ends meet, but at least he was free from the looming specter of debt. Student loans are only dischargeable if repayment is hopeless; you have to make every effort to repay them or to put yourself in a position where you’ll be able to repay them in the future. Bradley, a quadriplegic who pursued an education and still struggled to find employment that would cover his expenses, was one of the few for whom the court saw no hope for repayment.

Image from Flickr user StockMonkeys.com

About Russ Cope

Russ B. Cope is dedicated to legal standards that go far beyond filing cases — he is interested in your goals. Russ wants to be certain that each client is making an informed decision that will make their life better, and thrives on the interaction between lawyer and client.

Leave a Reply