Using Ohio Bankruptcy Exemptions

Bankruptcy exemptions allow you to prevent certain amounts of your property from being sold off in order to satisfy your debts. Under Ohio bankruptcy law, the “wildcard” exemption allows you to exempt up to $1,150 in any property of your choice. This means that you can apply this $1,150 to any number of properties as you see fit. Oh. Rev. Code § 2329.66(A)(18).

See also: Intentions matter when filing bankruptcy in Ohio

Ohio courts have decided that the wildcard exemption may be used to avoid judicial liens that you have against you. A lien is where your creditor has an ownership interest in your property, allowing them to restrict how that property is used or sold. However, you may be able to avoid a lien if it is impairing an exemption. Avoiding a lien means that a court has decided that it is unenforceable and thus the restrictions on your property are lifted. Ohio Revised Code § 522(f)(2)(A) explains what it means for an exemption to be impaired:

a lien shall be considered to impair an exemption to the extent that the sum of –

(i) the lien,

(ii) all other liens on the property; and

(iii) the amount of the exemption that the debtor could claim if there were no liens on the property;

exceeds the value that the debtor’s interest in the property would have in the absence of any liens.

In other words, a lien is impairing an exemption when the value of all liens and mortgages, plus the amount of the exemption, is greater than the actual value of the property. The value of the property is determined by an appraisal of what the property is worth at the time of filing for bankruptcy. The case of In re Oglesby, discussed below, illustrates the function of this legal rule.

In re Oglesby

In the bankruptcy case of In re Oglesby, the debtor, Mr. Oglesby, used his homestead exemption to exempt $5,000 of one parcel of property, and used his wildcard exemption to exempt only $1 on each of five other parcels of property that he owned. Mr. Oglesby’s creditor, Queen City Drywall, Inc., had a lien on all six parcels of property.

The court ruled that if that $1 added to the total amount of the liens held on each parcel of property exceeds the value of the properties themselves, then Mr. Oglesby has successfully avoided the liens that his creditors held against him. The court then crunched the numbers for each piece of property in turn:

Property # 1: The first property at issue was valued at $75,000. Mr. Oglesby had two mortgages on the property that totaled $256,000. Queen City Drywall had a lien on the property for $23,456.52, and Mr. Oglesby had a $1 wildcard exemption on the property. Adding the lien, the mortgage, and the exemption gives you $279,457.52. Because $279,457.52 is greater than the $75,000 value of the parcel, Mr. Oglesby’s exemption is considered impaired, and thus he can avoid the entire lien.

Property # 2: Mr. Oglesby applied his $5,000 homestead exemption to the second property, which was valued at $145,000. He had two mortgages that totaled $130,510, Queen City had a lien for $23,456.52, the I.R.S. had a tax lien for $45,065.05, and the State of Ohio had a lien for $868. Since the liens and the mortgages end up at $204,899.57, they are greater than the $145,000 value of the parcel, meaning that the exemption is impaired and thus the entire lien can be avoided.

Property # 3: The third parcel was valued at $320,000. Mr. Oglesby applied $1 of his wildcard exemption to the parcel. There was a mortgage and a delinquent real-estate tax lien on this parcel that for $319,500, an I.R.S. tax lien for $45,065.05, a lien from the State for $868, and again a lien by Queen City for $23,456.52. The mortgages, liens, and exemption added up to $388,890.57, meaning that the third parcel was impaired by $68,890.57 ($388,890.57 – $320,000). Hence, Mr. Oglesby was able to avoid the lien on the third parcel as well.

Property # 4: Mr. Oglesby’s fourth property had a $30,000 value. The liens and mortgage added up to $95,689.57, and Mr. Oglesby again applied a $1 wildcard exemption for a grand total of $95,690.57. Thus, the fourth property was impaired by $65,690.57, and Mr. Oglesby was able to avoid the lien.

Property #5: The fifth parcel was worth $78,000. As with the other properties, Mr. Oglesby applied his $1 wildcard exemption, and the amount of the liens plus the exemption equaled $139,112.57; impairing the loan by $61,112.57, and allowing Mr. Oglesby to avoid the lien on this property.

Property # 6: The final property was valued at $40,000. As you may have guessed, Mr. Oglesby added a $1 wildcard exemption to the existing liens and mortgages, for a total of $96,420.57. Therefore, the final lien was avoided as well because it was impaired by $56,420.57.

Conclusion

Mr. Oglesby’s financial condition was obviously poor, but some creative use of his wildcard exemption was able to assist him in getting the fresh start that bankruptcy is designed to provide. Exemptions are a tool designed to help you get to your new beginning without losing the shirt on your back. Accordingly, it pays to understand your unique financial situation in order to make the most of your exemptions. To better understand your bankruptcy, you should consult an experienced attorney who can help you through these difficult times.

See also: What Property Can I keep in Chapter 7? Ohio Homestead Exemption in Bankruptcy

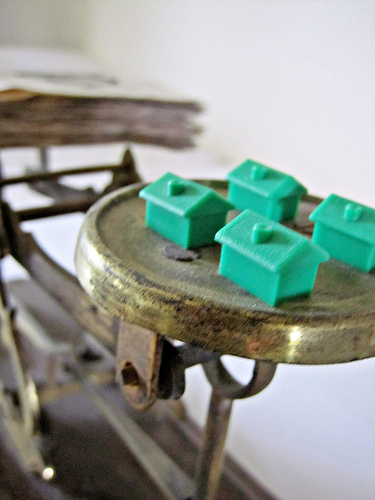

Image from Flickr user Images_of_Money

About Russ Cope

Russ B. Cope is dedicated to legal standards that go far beyond filing cases — he is interested in your goals. Russ wants to be certain that each client is making an informed decision that will make their life better, and thrives on the interaction between lawyer and client.

Leave a Reply