You probably already know that bankruptcy is going to impact your credit. In fact, fear of that impact may be what’s keeping you from filing. So how much does bankruptcy affect your credit score?

Contents

How Credit Scores Work

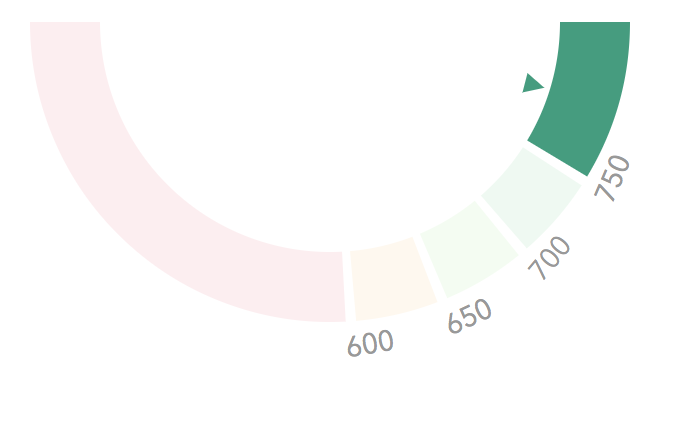

First, let’s take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individual’s credit score is proprietary — they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, they’ll check your credit. Some employers may even check your score when you apply for a job.

Your Credit Score and Bankruptcy

According to FICO’s damage points, the higher your starting score, the more points you’ll lose for filing for bankruptcy. For a person with a credit score of 680, filing for bankruptcy will lower your score by 130-150 points. For a person with a score of 780, filing for bankruptcy will cost you 220-240 points. The lower your score, the less it costs you.

To give some perspective, a foreclosure would cost you 85-105 points if your score was 680. If your score was 780, you’re looking at a drop of 140-160 points.

So how much does bankruptcy affect your credit score? The answer depends on where you started. If your score was very low because of accounts in default, in collections, wage garnishment, or other credit events, bankruptcy might not have a very big impact at all. In addition, bankruptcy will wipe out those issues that are continually hurting your credit score and allow you to start rebuilding your financial track record.

Options for Dealing with Debt

If you’re struggling with debt, it’s already reflected in your credit score. Maxing out credit cards and making late payments will lower your score. So will foreclosures and repossessions. However you deal with debt will also affect your score.

The first line of defense when you’re struggling with debt is to reach out to your lender. They may be willing to work with you to lower your monthly payments or your interest rate. Those agreements may or may not affect your credit score. You’ll have a more manageable monthly payment, but your overall debt load won’t change.

You may also seek help through a debt consolidation company. Debt consolidation can either lower or raise your credit, depending on your other finances and the vagaries of the score calculation by each agency. You’ll still have your debt, but consolidation may help you catch up on back payments and then stay current, which will improve your score.

If that doesn’t work or isn’t enough to help you, you may seek a debt settlement. In a debt settlement, you pay one lump sum of less than you owe to your lender in satisfaction of the debt. A debt settlement will cost you 45-65 points if your score was 680 prior to the settlement.

Bankruptcy May Be Your Best Bet

All of the above options depend on you having the means to pay some of your debt. That’s not always possible. If you’ve lost your job, for example, you probably don’t have the cash or income to put together a settlement payment or to make consolidated payments. If that’s the case, bankruptcy may be the best option for you.

When you file for bankruptcy, you either surrender your nonexempt assets under Chapter 7 or agree to a three- to five- year payment plan under Chapter 13. Credit bureaus don’t differentiate between types of bankruptcy. Filing under Chapter 7 will affect your score the same way filing under Chapter 13 would. Either one will cost you about 140 points if your score was 680. However, if you file for bankruptcy under Chapter 7, it will show on your report for about 10 years. If you file under Chapter 13, it will show for about seven years.

Consider that if you’re struggling with debt, your score may be significantly lower than 680. If you’ve missed a lot of payments or consolidated or settled some of your debt, you may not have much of a credit score to protect. If that’s the case, bankruptcy can help you start out fresh.

Fixing Your Credit Score After Bankruptcy

No matter what your score was prior to filing for bankruptcy, you can raise it back up with smart credit moves. The first step is getting a credit card. It won’t be easy after a bankruptcy, but some cards are easier to get than others. Consider a department store card, a secured card, or a card specifically for people with poor credit. Watch out for the fees. Some lenders offer subprime cards with extremely high interest rates and fees that send people straight back into debt.

Use the card wisely. Don’t exceed 25% of your credit limit (carrying a high balance will damage your score) and pay the card off in full every month. When you’ve built up some good credit, you’ll be able to get a credit card with more favorable terms. If you borrow to purchase a car or a home, make those payments in full and on time. You can boost your score back up into the 700s in just a handful of years.

See also: Will I be able to get credit after bankruptcy?

What’s best for me?

If you’re struggling with debt, you’re worried about more than just your credit score. Check out our other blog posts for detailed information about your options for dealing with debt or reach out to one of our experienced attorneys.

Image Courtesy Mint.com

About Russ Cope

Russ B. Cope is dedicated to legal standards that go far beyond filing cases — he is interested in your goals. Russ wants to be certain that each client is making an informed decision that will make their life better, and thrives on the interaction between lawyer and client.

Leave a Reply